www QuickBooks Online: Seriously, ditch the spreadsheets and embrace the future of accounting! This isn’t your grandpa’s bookkeeping software; QuickBooks Online (QBO) is a streamlined, user-friendly platform designed to make managing your finances less of a headache and more of a…well, manageable thing. From invoicing clients to tracking expenses, QBO offers a comprehensive suite of features tailored to businesses of all sizes, from solopreneurs to established enterprises.

We’ll dive into the features, pricing, user experience, and more, so get ready to level up your accounting game.

This guide will cover everything from the basics of creating invoices to understanding the more advanced features like financial reporting and integration with other business tools. We’ll also explore the different pricing tiers and help you determine which plan best fits your needs. Whether you’re a seasoned business owner or just starting out, this deep dive into QBO will equip you with the knowledge to effectively manage your finances.

QuickBooks Online Features

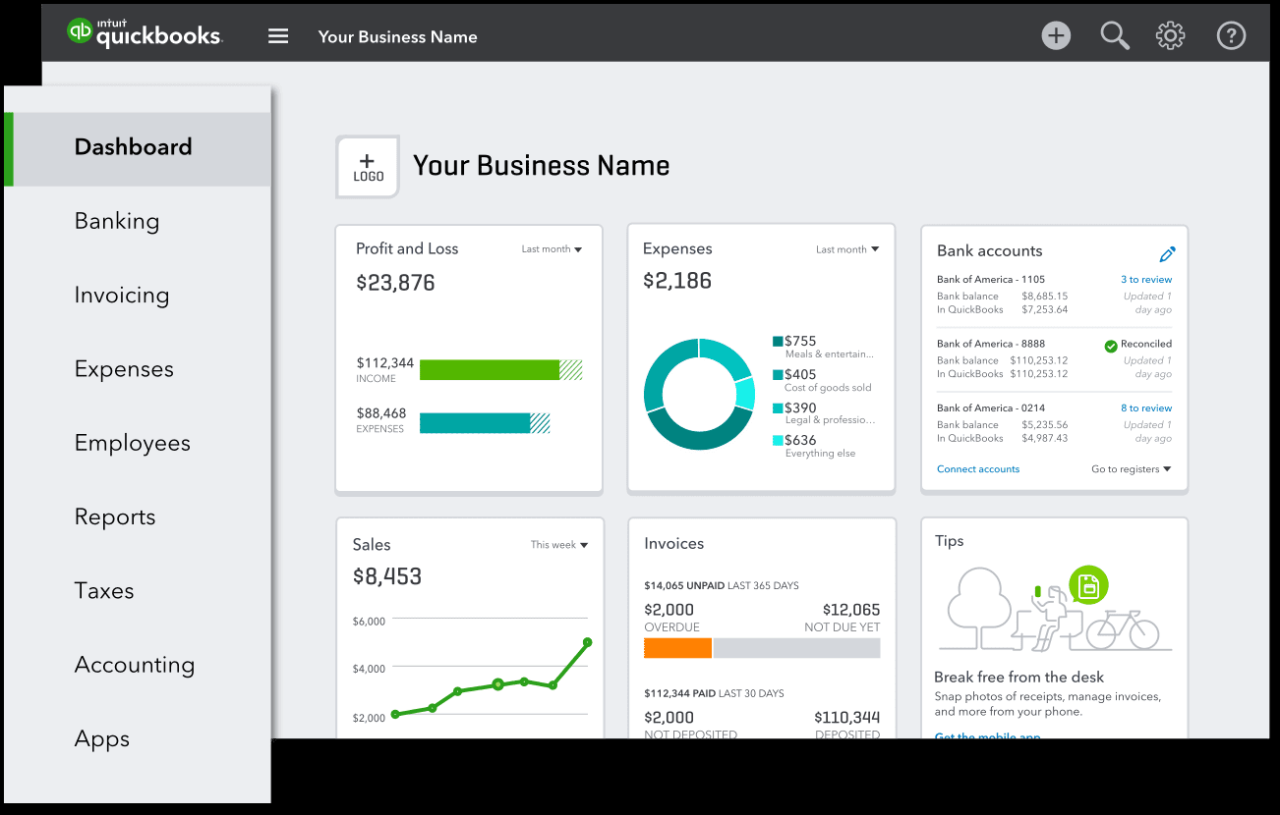

QuickBooks Online (QBO) is a cloud-based accounting software designed to simplify financial management for small and medium-sized businesses. It offers a range of features catering to various business needs, from basic bookkeeping to advanced inventory management. Its accessibility and intuitive interface make it a popular choice for entrepreneurs and business owners alike.

Core Features of QuickBooks Online

QBO’s core functionality revolves around streamlining accounting processes. This includes invoicing and expense tracking, allowing users to easily create and send professional invoices, record expenses, and manage payments. It also offers bank reconciliation, enabling users to match their bank statements with their QBO records, ensuring accuracy and identifying discrepancies. Reporting capabilities provide valuable insights into business performance, with customizable reports offering a clear picture of revenue, expenses, and profitability.

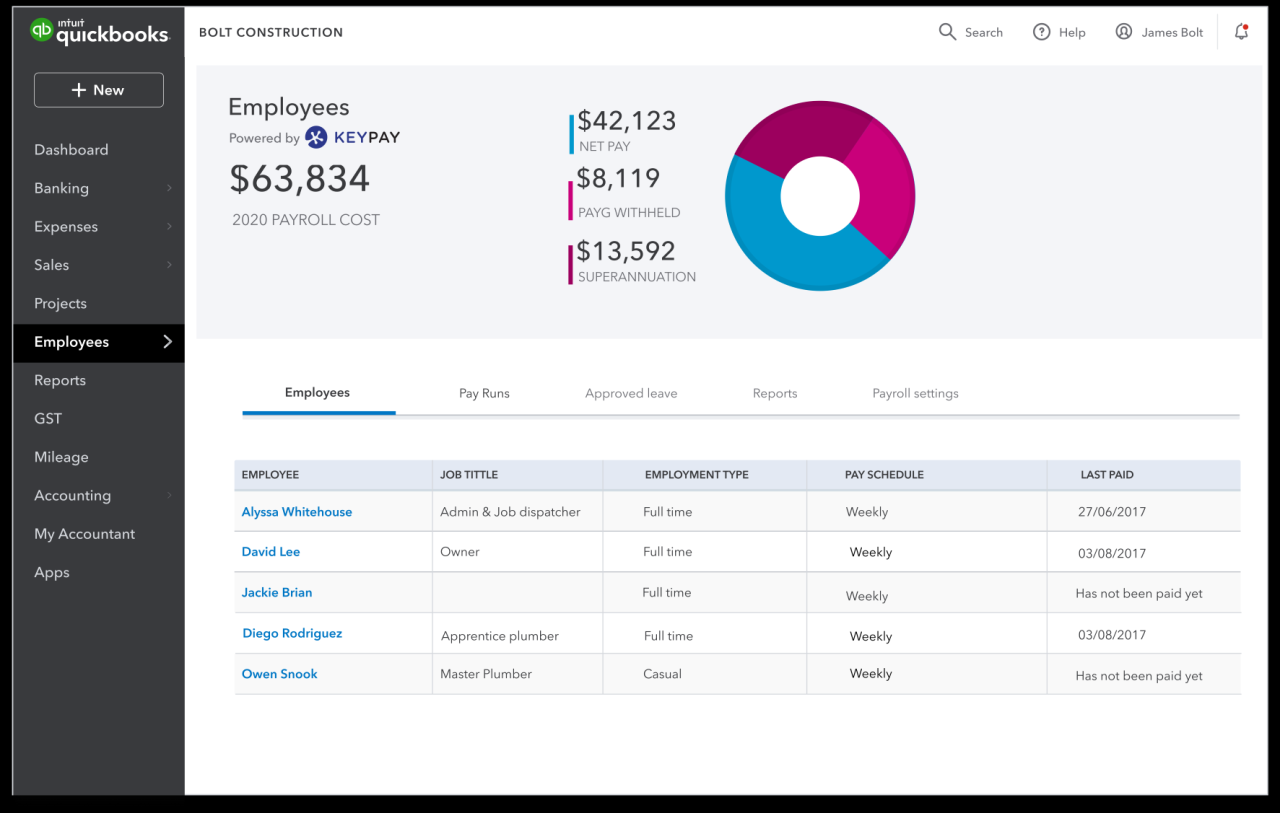

Furthermore, QBO facilitates inventory management, allowing businesses to track stock levels, costs, and sales. Finally, the software supports payroll processing, simplifying the often-complex task of paying employees.

QuickBooks Online Pricing Tiers and Functionalities

QuickBooks Online offers several pricing tiers, each with a different set of features. The Simple Start plan is ideal for solopreneurs and small businesses with basic accounting needs. It provides core features like invoicing, expense tracking, and basic reporting. The Essentials plan adds more advanced features, including bank feeds and more robust reporting options. The Plus plan is best suited for businesses requiring more comprehensive features such as inventory tracking and time tracking.

Advanced plans offer even more features such as project profitability and advanced inventory management. The specific features and pricing vary depending on the current QuickBooks Online offerings; it’s best to check the QuickBooks website for the most up-to-date information. Choosing the right plan depends on the size and complexity of your business.

QuickBooks Online Mobile App Capabilities

The QuickBooks Online mobile app extends the software’s functionality to smartphones and tablets. Users can access their financial data anytime, anywhere. Key features include creating and sending invoices, approving payments, tracking expenses on the go by snapping photos of receipts, and reviewing financial reports. The app mirrors many of the desktop features, offering a convenient and portable way to manage business finances.

This accessibility is particularly useful for business owners who are constantly on the move.

QuickBooks Online Integration Options

QBO boasts a robust ecosystem of integrations, expanding its capabilities significantly. It seamlessly integrates with various popular business applications, including payment processors like PayPal and Stripe, e-commerce platforms such as Shopify and Etsy, and CRM software like Salesforce. These integrations streamline workflows, eliminating the need for manual data entry and ensuring data consistency across different platforms. For example, integrating with Shopify automatically imports sales data into QBO, simplifying the reconciliation process.

This interconnectedness allows businesses to manage their entire financial ecosystem from a central hub.

User Experience and Interface

QuickBooks Online’s success hinges on its user experience. A clean, intuitive interface is crucial for small business owners juggling multiple tasks. A positive user experience translates to increased efficiency and ultimately, more time focusing on growing their business. This section will explore the ease of use, provide a step-by-step guide to a common task, and offer suggestions for interface improvements.

Creating an Invoice in QuickBooks Online

Creating invoices in QuickBooks Online is straightforward. The process is designed to be intuitive, even for users with limited accounting experience. Here’s a step-by-step guide:

- Select the “Invoices” tab: Locate and click the “Invoices” tab within the main QuickBooks Online dashboard. This usually resides in the left-hand navigation menu.

- Click “New”: Once on the Invoices page, click the “New” button (typically a prominent blue button or similar). This initiates the invoice creation process.

- Add Customer Information: Select the existing customer from the dropdown menu or add a new customer by clicking “New customer” and entering their details. Ensure the correct billing address is selected.

- Add Items: Enter the items or services provided. You can either manually type in the item details or use a previously saved item from your product/service list. Specify the quantity and price for each item.

- Add Additional Information (Optional): Add a message, notes, or any relevant information to the invoice. This could include payment terms, due dates, or specific instructions.

- Review and Save: Before sending, review all the details of the invoice to ensure accuracy. Once satisfied, click “Save and send” or “Save” depending on your preference for sending the invoice immediately or later.

User Testimonials

QuickBooks Online boasts a large and active user base. Many users praise the software’s ease of use. For example, one common testimonial highlights the intuitive interface, stating that “I was able to learn how to use it within an hour, and I’m not tech-savvy at all!” Another user commented on the time saved, stating that “QuickBooks Online has drastically reduced the time I spend on invoicing and bookkeeping, allowing me to focus on my core business.” These positive reviews reflect the software’s success in providing a user-friendly experience.

Proposed User Interface Improvement: Improved Item Search

Currently, searching for items within an invoice can be somewhat cumbersome. A proposed improvement would involve implementing a more robust search bar with auto-complete functionality. This improved search bar would instantly suggest matching items as the user types, drastically speeding up the process of adding items to invoices. Imagine a visually cleaner search bar positioned prominently at the top of the item entry section, with suggestions appearing in a dropdown box directly below as the user types.

This would significantly enhance the user experience, especially for businesses with a large inventory.

QuickBooks Online Features

| Feature | Description | Feature | Description |

|---|---|---|---|

| Invoicing | Create and send professional invoices quickly and easily. | Expense Tracking | Track business expenses and categorize them for tax purposes. |

| Financial Reporting | Generate various financial reports, such as profit & loss statements and balance sheets. | Payroll (Optional Add-on) | Manage employee payroll, including taxes and direct deposit. |

| Bank Reconciliation | Easily reconcile bank accounts to ensure accurate financial records. | Customer Management | Manage customer information, including contact details and payment history. |

| Time Tracking (Optional Add-on) | Track time spent on projects and tasks for accurate billing and project management. | Inventory Management (Optional Add-on) | Track inventory levels and manage stock. |

Accounting Processes in QuickBooks Online

QuickBooks Online (QBO) streamlines various accounting tasks, making it a popular choice for small businesses. Understanding its core processes is key to effectively managing your finances. This section will cover essential accounting functions within QBO, focusing on journal entries, bank reconciliations, accounts payable management, and inventory tracking.

Recording a Journal Entry in QuickBooks Online

Creating journal entries in QBO involves navigating to the “Journal” section. You’ll need to specify the date, account (debit and credit), and a description for each entry. QBO’s intuitive interface guides you through the process, ensuring accurate debits and credits balance. For instance, to record payment for office supplies, you would debit the “Office Supplies” expense account and credit the “Checking Account” asset account.

The description field allows you to add context, such as the vendor’s name and invoice number. QBO automatically updates the general ledger, maintaining a real-time view of your financial position.

Reconciling a Bank Account Using QuickBooks Online

Bank reconciliation in QBO involves comparing your bank statement with your QBO records. First, download your bank statement. Then, in QBO, navigate to the “Banking” tab and select the account to reconcile. QBO will compare transactions. You’ll review the list of transactions, marking those already recorded in QBO.

So, you’re using www.quickbooks.online, right? It’s awesome for managing your finances, but what happens if something goes wrong? If you ever face a major data loss, you’ll want to check out professional data recovery services ASAP to get your QuickBooks data back. Getting your financial records back is key, and thankfully, there are options to help you get back on track with www.quickbooks.online.

Any discrepancies – such as outstanding checks or deposits in transit – need to be manually added or adjusted. Once all transactions are accounted for, and the balances match, you finalize the reconciliation. This process ensures the accuracy of your financial records and helps identify any potential errors or discrepancies.

Managing Accounts Payable in QuickBooks Online

Managing accounts payable in QBO involves a straightforward workflow.

Imagine this workflow as three stages:

Stage 1: Entering Bills. When you receive an invoice from a vendor, you enter the bill into QBO. This involves inputting the vendor’s information, invoice date, due date, and the amounts owed. QBO will automatically record this as a liability on your balance sheet.

Stage 2: Paying Bills. When you’re ready to pay a bill, QBO allows you to select multiple invoices and generate payments. You can schedule payments for future dates and specify the payment method. QBO will automatically update your accounts payable and cash balances.

Stage 3: Reporting and Monitoring. QBO provides reports to track your accounts payable. You can view outstanding invoices, payment due dates, and other relevant information to manage your cash flow effectively.

Tracking Inventory Within QuickBooks Online

QBO offers several methods for tracking inventory, depending on your business needs. The simplest method is the average cost method, which calculates the cost of goods sold (COGS) based on the average cost of inventory items. For businesses with more complex inventory needs, QBO offers first-in, first-out (FIFO) and last-in, first-out (LIFO) methods. These methods track the cost of goods sold based on the order in which inventory items were purchased.

The choice of method impacts your COGS and ultimately your profit calculations. Businesses with a large inventory and frequent purchases may find FIFO or LIFO more suitable for accurate cost accounting, while smaller businesses might find the average cost method sufficient. Accurate inventory tracking is crucial for calculating COGS and ensuring your financial statements reflect your true profitability.

Reporting and Analytics

QuickBooks Online (QBO) offers a robust suite of reporting and analytics tools designed to give small business owners a clear picture of their financial health. These tools go beyond basic accounting functions, providing insights that can inform strategic decisions, optimize operations, and ultimately drive profitability. Understanding and utilizing these features is key to maximizing the value of QBO.QBO’s reporting capabilities provide valuable financial insights for various business needs.

The data presented allows for trend analysis, identification of areas needing improvement, and better forecasting. This information is crucial for informed decision-making, from pricing strategies to expense management.

Key Financial Reports and Their Uses

QBO generates a wide range of reports, each serving a specific purpose. For example, the Profit & Loss report shows revenue and expenses over a chosen period, highlighting profitability. The Balance Sheet provides a snapshot of assets, liabilities, and equity at a specific point in time. The Cash Flow statement tracks the movement of cash in and out of the business, crucial for managing liquidity.

Other important reports include Sales by Customer, which helps identify top-performing clients, and Accounts Receivable Aging, which assists in managing outstanding invoices. These reports are easily customizable, allowing users to filter data by date, customer, product, or other criteria.

Insights Gained from QuickBooks Online Reporting Features

By analyzing QBO’s reports, businesses gain a deeper understanding of their financial performance. For instance, tracking revenue trends over time can reveal seasonal fluctuations or the impact of marketing campaigns. Comparing expenses across different categories can highlight areas of overspending or potential cost-saving opportunities. Analyzing cash flow data helps predict future cash needs and avoid potential shortfalls.

The data-driven insights provided by QBO’s reporting empower informed decisions related to pricing, budgeting, and investment.

Examples of Business Use of QuickBooks Online Reporting for Informed Decisions

Imagine a bakery using QBO’s Sales by Item report to identify their best-selling pastries. This data could inform decisions about increasing production of popular items or adjusting pricing strategies. A consulting firm might use the Profit & Loss report to track the profitability of individual projects, allowing them to identify successful strategies and discontinue underperforming ones. A retail store could leverage the Accounts Receivable Aging report to target overdue invoices and improve cash flow management.

In each case, QBO’s reporting provides the crucial data to make strategic, data-driven decisions.

Categorized List of QuickBooks Online Reporting Types

The reports in QBO are broadly categorized for easy navigation. A simplified categorization could include:

- Profitability Reports: Profit & Loss, Profit & Loss by Customer, Profit & Loss by Product/Service

- Balance Sheet Reports: Balance Sheet, Comparative Balance Sheet

- Cash Flow Reports: Cash Flow Statement, Cash Flow Forecast

- Sales Reports: Sales by Customer, Sales by Item, Sales Tax Summary

- Accounts Receivable/Payable Reports: Accounts Receivable Aging, Accounts Payable Aging

- Other Reports: General Ledger, Trial Balance, Chart of Accounts

QuickBooks Online Security: Www Quickbooks Online

Protecting your financial data is paramount, and QuickBooks Online (QBO) employs a multi-layered approach to security. Understanding these measures and implementing best practices is crucial for maintaining the confidentiality, integrity, and availability of your business information. This section will detail the security features of QBO, best practices for user security, password recovery procedures, and a brief comparison with a competitor.

Security Measures Implemented by QuickBooks Online

QuickBooks Online utilizes a robust security infrastructure to safeguard user data. This includes data encryption both in transit and at rest, meaning your information is protected as it travels to and from QBO servers and while stored on their systems. Intrusion detection and prevention systems constantly monitor for suspicious activity, and regular security audits ensure compliance with industry best practices.

Multi-factor authentication (MFA) adds an extra layer of protection, requiring users to verify their identity through a second method, such as a code sent to their phone or email, in addition to their password. Access controls allow administrators to manage user permissions, ensuring only authorized individuals can access sensitive data. Finally, QBO benefits from the security infrastructure of Intuit, a large company with significant resources dedicated to cybersecurity.

Best Practices for Securing a QuickBooks Online Account

Strong passwords are foundational to account security. A strong password is long, complex, and unique to your QBO account. Avoid using easily guessable information like birthdays or pet names. Enabling multi-factor authentication (MFA) is highly recommended as it significantly reduces the risk of unauthorized access, even if your password is compromised. Regularly reviewing your user permissions and access levels is essential, removing access for employees who no longer need it.

Be cautious of phishing emails or suspicious links; QBO will never ask for your password via email. Keeping your software updated is crucial, as updates often include important security patches. Finally, consider using a password manager to securely store and manage your passwords.

QuickBooks Online Password Recovery

If you forget your QuickBooks Online password, you can initiate a password reset through the QBO login page. You’ll typically be prompted to answer security questions or receive a verification code via email or phone, depending on your security settings. Following the on-screen instructions will guide you through the process of creating a new password. It’s important to note that the complexity requirements for passwords may vary; ensure your new password meets those criteria.

If you encounter difficulties, contacting QuickBooks Online support directly is recommended.

Comparison of QuickBooks Online Security with a Competitor (Xero)

Both QuickBooks Online and Xero, leading cloud-based accounting software, offer strong security features. Both utilize data encryption, multi-factor authentication, and access controls. However, specific implementations and details may differ. For example, while both offer MFA, the specific methods and user experience may vary slightly. Similarly, their approaches to security audits and compliance certifications might differ in their specifics.

Ultimately, both platforms prioritize security, but a thorough comparison of their specific security documentation would be necessary for a definitive assessment of their relative strengths. This comparison highlights the importance of reviewing the security features of any accounting software before making a selection.

Customer Support and Resources

QuickBooks Online (QBO), like any robust software, needs a strong support system to back up its features. Access to helpful resources and responsive customer service is crucial for users to navigate the platform effectively and resolve issues promptly. Understanding the available support channels and learning resources is key to a smooth QBO experience.

Available Customer Support Channels

QuickBooks Online offers a multi-faceted approach to customer support, catering to various user preferences and needs. Users can choose from several avenues to get assistance. This variety ensures that help is readily accessible regardless of the user’s comfort level with technology or the urgency of their issue.

- Phone Support: Direct phone contact with QuickBooks support representatives provides immediate assistance for urgent problems. This method is particularly useful for users who prefer a more interactive and personalized support experience.

- Email Support: For less urgent issues, email support offers a convenient way to document problems and receive detailed responses. Users can attach relevant screenshots or files to help clarify their questions.

- Chat Support: Live chat offers a quick and easy way to get answers to simple questions or troubleshooting steps. This option is ideal for users who need a fast response without the need for a phone call.

- Help Center/Knowledge Base: An extensive online help center provides articles, FAQs, and video tutorials covering a wide range of topics. This self-service option allows users to find solutions independently, often faster than waiting for a support representative.

- Community Forums: QBO’s online community forums allow users to connect with each other and share solutions and experiences. This peer-to-peer support can be invaluable for finding answers to less common problems or getting different perspectives on a specific issue.

User Reviews of QuickBooks Online Customer Support

User reviews of QBO’s customer support are mixed. While many praise the comprehensive help center and the availability of multiple support channels, some users report long wait times for phone support, particularly during peak hours. Others find the online help center difficult to navigate, despite its extensive content. Positive reviews frequently highlight the helpfulness and knowledge of the support representatives, while negative reviews often cite difficulties in clearly explaining the issue to the representative or receiving a satisfactory resolution.

The overall experience seems to depend heavily on the specific issue encountered and the time of day the user seeks assistance.

Troubleshooting a Common QuickBooks Online Problem: Reconciling Bank Accounts

Reconciling bank accounts is a critical step in maintaining accurate financial records. Difficulties in this process are common among QBO users. The following flowchart Artikels the steps to troubleshoot discrepancies during reconciliation:

- Identify the Discrepancy: Compare the ending balance in QBO with the ending balance on your bank statement. Note the difference.

- Review Unreconciled Transactions: Check for any transactions in QBO that haven’t been marked as reconciled. These might include deposits, payments, or fees.

- Check for Missing Transactions: Ensure all transactions from your bank statement are recorded in QBO. Look for missing deposits, payments, or fees.

- Verify Transaction Amounts: Double-check the amounts of all transactions in QBO against the bank statement. Even small discrepancies can throw off the reconciliation.

- Investigate Discrepancies: If discrepancies persist, investigate the source. This may involve contacting your bank to inquire about potential errors or reviewing your QBO entries for inaccuracies.

- Correct Errors: Once the source of the discrepancy is identified, correct any errors in QBO. This may involve editing existing transactions or adding new ones.

- Reconcile Again: After correcting errors, attempt to reconcile the account again. The balances should now match.

- Contact Support (If Necessary): If you are still unable to reconcile your account after following these steps, contact QuickBooks support for assistance.

Available Learning Resources for QuickBooks Online

QBO offers a variety of learning resources to help users master the software. These resources range from introductory tutorials to advanced training materials, catering to users of all skill levels.

- QuickBooks Online Help Center: This comprehensive resource contains articles, FAQs, and video tutorials covering a wide range of topics.

- QuickBooks Online Tutorials: Short video tutorials provide step-by-step guidance on specific tasks and features within QBO.

- QuickBooks Online Webinars: Live and on-demand webinars offer in-depth training on various aspects of QBO, often led by QuickBooks experts.

- QuickBooks Online User Community: The online community forum allows users to connect with each other and share tips, tricks, and solutions.

- Third-Party Training Resources: Numerous third-party websites and training companies offer courses and certifications on QuickBooks Online.

QuickBooks Online Integrations

QuickBooks Online’s power significantly expands when integrated with other business tools. Connecting QuickBooks Online to your CRM, e-commerce platform, or other apps streamlines workflows, improves data accuracy, and ultimately saves you time and money. This allows for a more holistic view of your business operations, facilitating better decision-making.Integrating QuickBooks Online with other applications offers several key benefits. Automation is a major advantage, reducing manual data entry and the associated risk of errors.

This integration allows for a seamless flow of information between different systems, creating a centralized hub for financial data. Furthermore, improved reporting and analytics become possible as integrated data provides a richer and more comprehensive view of your business performance. Ultimately, this leads to better efficiency and more informed business strategies.

Connecting QuickBooks Online to Other Applications

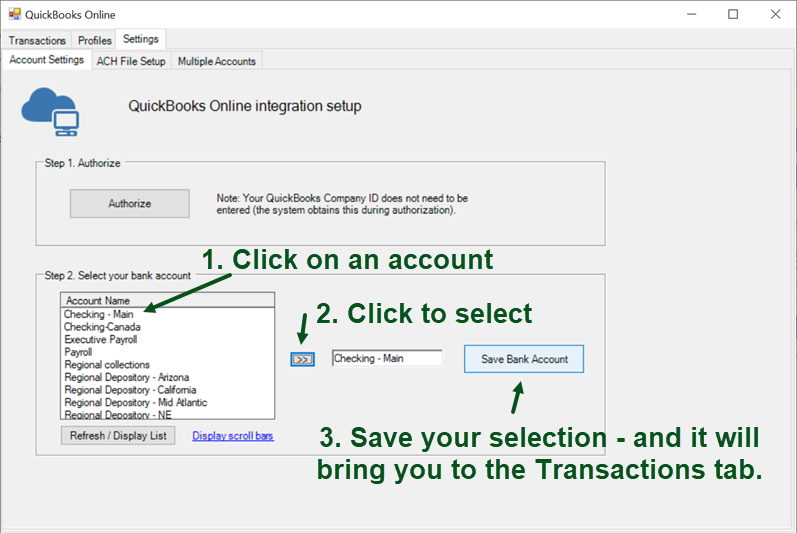

Connecting QuickBooks Online to a CRM (like Salesforce or HubSpot) or an e-commerce platform (like Shopify or WooCommerce) typically involves a straightforward process. Most integrations utilize APIs (Application Programming Interfaces) that allow different software systems to communicate. Often, the process begins within the QuickBooks Online app itself, where you’ll find a section dedicated to apps and integrations. You’ll select the desired application, authorize access, and follow the platform’s specific instructions to link the accounts.

This usually involves providing API keys or other authentication credentials. After successful connection, data will begin to sync, automatically updating relevant information in both systems. For example, customer information from a CRM might automatically populate in QuickBooks Online, or sales data from an e-commerce platform could seamlessly integrate with QuickBooks Online’s invoicing and accounting features.

Comparison of QuickBooks Online Integrations

The performance and reliability of QuickBooks Online integrations vary depending on the specific application and the quality of the integration itself. Factors influencing performance include the volume of data being synced, the frequency of updates, and the overall stability of both QuickBooks Online and the integrated application. Some integrations might be more seamless and efficient than others, while some may experience occasional glitches or delays.

Choosing a well-established and frequently updated integration is crucial for ensuring reliable performance. Reading reviews and checking the integration’s support documentation can help in making an informed decision. For instance, an integration with a popular, well-supported CRM will generally offer better performance and reliability compared to a lesser-known or less-maintained integration.

Popular QuickBooks Online Integrations and Their Functionalities

The following table lists some popular integrations and their key functionalities:

| Integration | Category | Key Functionalities | Notes |

|---|---|---|---|

| Shopify | E-commerce | Automatic import of sales data, inventory management synchronization | Seamless integration for online stores |

| Salesforce | CRM | Customer data synchronization, improved sales tracking, streamlined invoicing | Powerful integration for sales-focused businesses |

| HubSpot | CRM & Marketing | Customer relationship management, marketing automation, sales pipeline integration | Comprehensive integration for marketing and sales teams |

| Xero | Accounting | Data migration, financial reporting consolidation | Useful for businesses switching accounting platforms |

QuickBooks Online for Different Business Types

QuickBooks Online (QBO) adapts to the diverse needs of businesses, from solo entrepreneurs to larger enterprises. Its modular design allows businesses to select the features most relevant to their size, industry, and operational complexity, ensuring a scalable and efficient accounting solution. This adaptability is a key factor in QBO’s widespread adoption across various business models.

QuickBooks Online for Small Businesses

QBO offers a streamlined solution for small businesses, simplifying tasks like invoicing, expense tracking, and financial reporting. Its intuitive interface and user-friendly features make it accessible even for those with limited accounting experience. Small businesses can easily manage their cash flow, track inventory (if applicable), and generate reports to monitor their financial health. Features like automated bank feeds and expense categorization save time and reduce the risk of manual errors, allowing small business owners to focus on core business activities.

For example, a local bakery could use QBO to manage sales, track ingredient costs, and generate reports on profitability, all within a single, user-friendly platform.

QuickBooks Online for Freelancers and Independent Contractors

Freelancers and independent contractors often benefit from QBO’s ease of use and mobile accessibility. The ability to create and send professional invoices quickly is crucial, and QBO excels in this area. Expense tracking is simplified through features like mobile receipt capture, allowing for accurate record-keeping on the go. Furthermore, QBO can help freelancers generate reports for tax preparation, making compliance easier.

Imagine a freelance graphic designer using QBO to invoice clients, track project expenses, and prepare a comprehensive profit and loss statement at tax time; this simplifies their administrative burden significantly.

QuickBooks Online for Larger Businesses

While initially designed for smaller businesses, QBO offers scalable solutions for larger enterprises through its advanced features and add-ons. Larger businesses can leverage QBO’s robust reporting capabilities for in-depth financial analysis. Features like advanced inventory management, multi-currency support, and custom reporting options cater to the complex needs of larger organizations. Furthermore, QBO’s integration capabilities allow seamless data exchange with other business applications, streamlining workflows.

A mid-sized manufacturing company, for example, might utilize QBO’s inventory tracking features to monitor stock levels, manage production costs, and forecast future demand, integrating this data with their production planning software.

QuickBooks Online Across Different Industry Sectors

QBO’s adaptability extends to various industry sectors. While its core functionality remains consistent, specific features become more or less relevant depending on the industry. For example, a retail business might heavily utilize inventory management features, while a service-based business might focus more on time tracking and project management. The platform’s flexibility allows businesses in diverse sectors – from restaurants and healthcare to construction and e-commerce – to customize their experience to fit their specific needs.

QBO’s adaptability allows it to serve as a comprehensive accounting solution regardless of the industry.

QuickBooks Online Pricing and Value

Choosing the right accounting software involves careful consideration of pricing and the overall value it provides. QuickBooks Online offers a tiered pricing structure, meaning the cost varies depending on your business needs and the features you require. Understanding this structure and how it relates to your business’s size and growth potential is crucial for making an informed decision.

QuickBooks Online Pricing Plans

QuickBooks Online offers several plans, each with a different price point and feature set. The Simple Start plan is best for small businesses with basic accounting needs, while the Essentials and Plus plans provide more advanced features for growing businesses. The Advanced plan caters to larger businesses with more complex requirements. Prices vary based on the plan and are typically billed monthly or annually.

For example, the Simple Start plan might cost around $25 per month, while the Plus plan could be closer to $80 per month. It’s always best to check the official QuickBooks website for the most up-to-date pricing information, as these prices can change.

Return on Investment (ROI) of QuickBooks Online

The ROI of QuickBooks Online depends heavily on the size and type of business. For a small sole proprietorship, the cost savings from reduced accounting fees and increased efficiency might quickly outweigh the monthly subscription. Imagine a freelancer who previously spent hours each month on manual bookkeeping. QuickBooks Online could automate many of these tasks, freeing up their time to focus on client work—a direct increase in revenue.

For larger businesses, the ROI might be less immediately apparent but still significant. The improved accuracy of financial data, streamlined processes, and enhanced reporting capabilities can lead to better decision-making and increased profitability in the long run. For example, a medium-sized business might see improved inventory management, reducing waste and increasing efficiency, leading to a substantial cost saving over time.

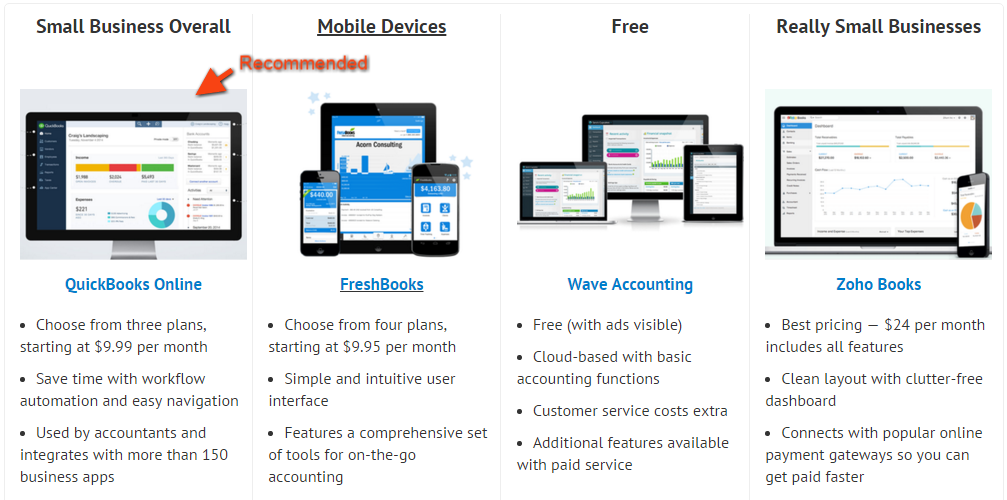

Comparison with Other Accounting Software

QuickBooks Online competes with several other accounting software solutions, including Xero, Zoho Books, and FreshBooks. A direct comparison requires looking at features, pricing, and ease of use. While Xero might offer similar features, its pricing structure might differ. Zoho Books presents a more budget-friendly option, but it might lack some of the advanced features found in QuickBooks Online. FreshBooks, geared more toward freelancers and small businesses, might be a suitable alternative depending on your specific needs.

The best choice depends on your business’s unique requirements and budget.

Cost-Benefit Analysis of QuickBooks Online

| Benefit | Cost | Example | Overall Impact |

|---|---|---|---|

| Time Savings (automation) | Monthly subscription fee (e.g., $25-$80) | Reduced time spent on bookkeeping, allowing for more client work or strategic planning. | Positive – increased revenue and efficiency |

| Improved Accuracy | Monthly subscription fee | Minimized errors in financial reporting, leading to better decision-making. | Positive – reduced risk of financial errors |

| Enhanced Reporting | Monthly subscription fee | Access to real-time financial data and customizable reports for better business insights. | Positive – improved business understanding and strategic planning |

| Scalability | Increased subscription fee as business grows | Ability to upgrade to a more comprehensive plan as your business expands. | Positive – adaptability to changing business needs |

Future of QuickBooks Online

QuickBooks Online (QBO) is constantly evolving to meet the ever-changing needs of businesses. Its future hinges on leveraging emerging technologies and adapting to the shifting landscape of business practices, promising a more integrated, intelligent, and user-friendly experience. We can expect significant advancements in several key areas.

The integration of AI and machine learning will be central to QBO’s future development. This will allow for more sophisticated automation, predictive analytics, and personalized support. Imagine a system that automatically categorizes transactions, identifies potential tax deductions, and even proactively suggests financial strategies based on a business’s unique data. This level of intelligent automation will save businesses significant time and resources.

Enhanced AI-Powered Features

The incorporation of advanced AI capabilities will transform many aspects of QBO. For instance, more robust and accurate expense tracking will be possible through AI-driven receipt processing and intelligent categorization. Predictive analytics, powered by machine learning algorithms, will provide businesses with valuable insights into their financial performance, allowing for better forecasting and strategic decision-making. This predictive capability could, for example, forecast cash flow more accurately, helping businesses avoid potential shortfalls.

Improved natural language processing will allow users to interact with the software more naturally, using conversational commands to perform tasks.

Impact of Blockchain Technology

Blockchain technology offers the potential to revolutionize accounting by providing a secure and transparent ledger. While full integration may take time, we can expect QBO to explore ways to leverage blockchain for enhanced security, particularly in areas like invoice verification and financial record management. This could lead to a system where invoices are automatically verified and recorded, reducing the risk of fraud and disputes.

Imagine a future where supply chain management is integrated, providing real-time visibility into payments and transactions across the entire chain.

Adapting to the Rise of Remote Work and the Gig Economy

The increasing prevalence of remote work and the gig economy demands flexibility and scalability in accounting software. QBO will likely adapt by offering more streamlined features for managing independent contractors, tracking project-based expenses, and integrating with various remote work platforms. For example, improved expense reporting features that allow easy submission and approval of expenses from anywhere, anytime, would greatly benefit freelancers and remote workers.

This could also include features specifically designed for managing multiple income streams, a common characteristic of gig economy participation.

Predicted Future Improvements and Changes

The following list highlights some predicted improvements and changes for QuickBooks Online:

These predictions are based on current trends in technology and the evolving needs of businesses. The integration of these improvements will solidify QBO’s position as a leading accounting software solution, catering to the demands of a rapidly changing business environment.

- Improved mobile app functionality with offline access.

- Enhanced integration with other business applications (CRM, project management, etc.).

- More sophisticated reporting and analytics dashboards with customizable views.

- Advanced security features, including multi-factor authentication and enhanced data encryption.

- Personalized support and onboarding experiences tailored to individual business needs.

QuickBooks Online vs. Desktop Version

Choosing between QuickBooks Online and the desktop version depends heavily on your business needs and technological comfort level. Both offer robust accounting features, but their delivery and accessibility differ significantly, impacting workflow and overall user experience. This comparison highlights key distinctions to aid in making an informed decision.

Feature and Functionality Comparison

QuickBooks Online and the desktop version share a core set of accounting functions, including invoicing, expense tracking, financial reporting, and bank reconciliation. However, the desktop version generally boasts a more extensive feature set, particularly regarding inventory management and advanced reporting capabilities. QuickBooks Online, on the other hand, excels in its accessibility and collaborative features, allowing multiple users to access the data simultaneously from various locations.

The desktop version is more self-contained and requires local installation, while the online version relies on a stable internet connection.

Advantages and Disadvantages for Different User Types, Www quickbooks online

Solopreneurs/Small Businesses: QuickBooks Online’s accessibility and affordability often make it the ideal choice. The lack of extensive local installation and maintenance is a significant advantage. However, businesses with complex inventory needs might find the desktop version more suitable.

Medium-Sized Businesses: Medium-sized businesses often benefit from the enhanced reporting and inventory management capabilities of the desktop version. However, the collaborative features and accessibility of QuickBooks Online can be invaluable for teams working remotely or in multiple locations. A hybrid approach, utilizing both versions, might be the most efficient solution.

Large Enterprises: Large enterprises typically require highly customized solutions and often integrate QuickBooks with other enterprise resource planning (ERP) systems. While the desktop version offers more customization options, many large businesses are increasingly adopting cloud-based solutions like QuickBooks Online for enhanced collaboration and scalability.

Migration Process from Desktop to QuickBooks Online

Migrating from the desktop version to QuickBooks Online involves several steps. First, a thorough data backup of the desktop version is crucial. Intuit provides tools and resources to facilitate this migration. The data is then imported into QuickBooks Online, a process that can take time depending on the size of the data set. Intuit’s support team can assist with this process, addressing any challenges encountered.

Post-migration, a careful review and reconciliation of data are essential to ensure accuracy. Training on the new interface and features might be necessary for users unfamiliar with QuickBooks Online.

Key Differences Between QuickBooks Online and Desktop Version

| Feature | QuickBooks Online | QuickBooks Desktop | Considerations |

|---|---|---|---|

| Accessibility | Cloud-based; accessible from anywhere with internet | Local installation; requires computer access | Online version offers greater flexibility. |

| Collaboration | Multiple users can access and work simultaneously | Limited multi-user capabilities; requires network setup | Online version is better for teams. |

| Cost | Subscription-based; typically lower upfront cost | One-time purchase; potential for higher initial investment | Online version has predictable monthly expenses. |

| Software Updates | Automatic updates; always using the latest version | Manual updates; requires user action and downtime | Online eliminates update hassles. |

Last Word

So, there you have it – a comprehensive look at www QuickBooks Online. From its intuitive interface and robust features to its powerful reporting capabilities and excellent customer support, QBO truly stands out as a leading accounting solution. While choosing the right accounting software can feel overwhelming, understanding QBO’s strengths and functionalities empowers you to make informed decisions that benefit your business.

Whether you’re a freelancer juggling multiple projects or running a large corporation, QBO offers the flexibility and scalability to meet your unique financial needs. Ready to streamline your finances and focus on what matters most – growing your business? Then dive in and explore all that QBO has to offer!

User Queries

Can I access QuickBooks Online offline?

Nope, QBO is a cloud-based software, meaning you need an internet connection to use it.

What happens if I forget my password?

QBO has a password recovery system; just follow the prompts on the login page.

Is QuickBooks Online secure?

Yes, QBO uses robust security measures including encryption and two-factor authentication to protect your data.

Does QuickBooks Online integrate with other apps?

Absolutely! It integrates with many popular apps like Shopify, PayPal, and many CRM platforms.

What kind of customer support does QuickBooks Online offer?

They offer phone, email, and online help resources. Check their website for the most up-to-date options.