TurboTax 2021 was a pretty big deal for tax season, and whether you loved it or hated it, it definitely left its mark. This guide dives deep into the software, exploring everything from its user-friendly (or not-so-friendly) interface to its pricing and features. We’ll uncover common user gripes, discuss its accessibility, and even compare it to the competition. Get ready to become a TurboTax 2021 expert!

We’ll cover the nitty-gritty details, from navigating the software to understanding its security measures. We’ll also tackle some frequently asked questions, helping you avoid those frustrating tax season headaches. So, buckle up, because we’re about to untangle the complexities of TurboTax 2021.

TurboTax 2021 User Experience

TurboTax 2021, like any tax software, aimed to simplify the often-daunting process of filing taxes. Its success, however, hinged on a user-friendly interface and a smooth, intuitive workflow. This section will explore the user experience of TurboTax 2021, examining its design, common frustrations, and accessibility features.

TurboTax 2021 User Flow Diagram

The following table illustrates a simplified user flow for filing taxes using TurboTax 2021. The actual process can vary depending on individual circumstances and the complexity of the tax return.

| Step | Action | Expected Outcome | Potential Issues |

|---|---|---|---|

| 1 | Start TurboTax and select filing type (e.g., Single, Married Filing Jointly). | Software guides user to relevant forms and questions. | Incorrect selection leading to irrelevant questions. |

| 2 | Provide personal information (name, address, SSN, etc.). | Software verifies information and proceeds to next steps. | Data entry errors requiring correction. |

| 3 | Answer questions about income (W-2s, 1099s, etc.). | Software calculates income and potential deductions. | Misunderstanding of questions, leading to inaccurate data entry. |

| 4 | Answer questions about deductions and credits (e.g., charitable contributions, student loan interest). | Software calculates tax liability. | Difficulty understanding complex tax rules and their implications. |

| 5 | Review the tax return. | Opportunity to review calculations and make corrections. | Overlooking errors or missing deductions. |

| 6 | E-file or print and mail the return. | Successful tax filing. | Technical issues with e-filing, errors during printing. |

Common User Frustrations with TurboTax 2021

Many online reviews and forum discussions highlight recurring frustrations with TurboTax 2021. These issues often stemmed from the software’s design and its handling of complex tax situations.

Common complaints included:

- Confusing Navigation: Users reported difficulty navigating the software, finding specific sections, and understanding the flow of questions.

- Unexpected Costs: The “free” version often transitioned to paid versions unexpectedly, leading to user dissatisfaction and feelings of being misled.

- Complex Tax Situations: The software struggled to handle complex tax situations, leaving users confused and needing professional assistance.

- Technical Glitches: Users experienced various technical issues, including crashes, data loss, and slow loading times.

- Lack of Clear Explanations: The software sometimes lacked clear explanations of tax terms and concepts, making it difficult for users to understand their tax obligations.

Accessibility Features in TurboTax 2021

While TurboTax 2021 aimed for broad accessibility, reviews suggest that the software fell short in several areas. Specific details regarding screen reader compatibility, keyboard navigation, and other assistive technology support were often inconsistent across user experiences. Many users with disabilities reported difficulty navigating the software and accessing key information. Intuit, the maker of TurboTax, offered some accessibility features, but user feedback indicates a need for further improvements to ensure full compliance with accessibility standards and to meet the diverse needs of users with disabilities.

TurboTax 2021 Features and Functionality

TurboTax 2021 offered a range of features designed to simplify the tax filing process, catering to different user needs and levels of tax complexity. The software’s tiered pricing structure – Deluxe, Premier, and Home & Business – reflected varying levels of included features and support. This analysis explores the functionality across these tiers, providing a step-by-step guide for simple tax filing and highlighting key updates from previous versions.

Feature Comparison Across TurboTax 2021 Pricing Tiers

The following table compares the features available in each TurboTax 2021 pricing tier. Note that specific features and their availability may have varied slightly depending on state and individual circumstances.

| Feature | Deluxe | Premier | Home & Business |

|---|---|---|---|

| Basic Tax Form Support (1040, Schedules A, B, C-EZ, etc.) | Yes | Yes | Yes |

| State Tax Filing | Yes | Yes | Yes |

| Itemized Deduction Guidance | Yes | Yes | Yes |

| Investment Income Support (Stocks, Bonds, etc.) | No | Yes | Yes |

| Rental Property Support | No | Yes | Yes |

| Business Income/Expense Support | No | No | Yes |

Filing a Simple Tax Return in TurboTax 2021

This guide Artikels the process for filing a simple tax return using TurboTax 2021. This assumes a straightforward return with W-2 income and standard deduction. More complex situations will require additional steps.

- Personal Information: Begin by entering your personal information, including your Social Security number, address, and filing status (single, married filing jointly, etc.).

- Income Information: Input your W-2 information from your employer, including your wages, federal and state withholdings. TurboTax will guide you through entering the relevant data from your W-2 form.

- Deductions: Choose whether to take the standard deduction or itemize. For a simple return, the standard deduction is typically selected. TurboTax will automatically calculate this based on your filing status and age.

- Credits: Review and claim any applicable tax credits, such as the Earned Income Tax Credit (EITC) if eligible. TurboTax will ask qualifying questions to determine eligibility.

- Review and File: Carefully review your completed return for accuracy. Once you’re satisfied, you can choose to file electronically or print and mail your return (though electronic filing is strongly recommended).

Significant Changes and Updates in TurboTax 2021

TurboTax 2021 incorporated several updates compared to previous versions. While specific features varied, many versions included improved user interface elements for smoother navigation and more intuitive data entry. Many users reported that the software’s guidance for claiming various credits and deductions was enhanced, reducing confusion and improving accuracy. Specific updates might have included adjustments to reflect changes in tax laws enacted for the 2021 tax year.

For example, any changes to tax brackets, standard deduction amounts, or new or modified tax credits would be incorporated into the software.

TurboTax 2021 Pricing and Value

Choosing the right tax software can feel like navigating a minefield, especially when considering price. TurboTax 2021 offered a range of products, each with varying features and price points, designed to cater to different user needs and tax complexities. Understanding the pricing structure and comparing it to competitors is crucial for making an informed decision.TurboTax 2021’s pricing model was tiered, with options ranging from basic filing for simple returns to more comprehensive packages for self-employed individuals or those with complex investments.

The cost varied based on the chosen product and any additional services purchased. This tiered system, while offering flexibility, also presented the challenge of selecting the most cost-effective option for one’s specific circumstances. This meant users needed to carefully evaluate their tax situation to avoid overspending on features they didn’t need.

TurboTax 2021 Pricing Comparison with Competitors

The following table compares the pricing and features of TurboTax 2021 with similar tax preparation software options available around the same time. Keep in mind that pricing can fluctuate year to year, and specific features may vary depending on the software version and add-ons. This comparison offers a general overview of the market landscape.

| Software | Basic Price Range (USD) | Key Features | Target User |

|---|---|---|---|

| TurboTax Deluxe | $50 – $80 | Itemized deductions, state tax support, investment income | Individuals with moderate tax situations, including investments. |

| TurboTax Premier | $80 – $100 | All Deluxe features, plus support for rental properties, capital gains, and self-employment | Individuals with rental income or significant investments. |

| H&R Block Deluxe | $50 – $70 | Similar features to TurboTax Deluxe, including itemized deductions and state tax support | Individuals with moderate tax situations. |

| TaxAct Deluxe | $40 – $60 | Features comparable to TurboTax Deluxe and H&R Block Deluxe, focusing on ease of use | Individuals seeking a simple and affordable tax filing solution. |

Cost-Saving Strategies for TurboTax 2021 Users

Several strategies could help users minimize their TurboTax 2021 expenses. Careful planning and awareness of available options are key to saving money.One significant way to save money was to accurately assess one’s tax needs before purchasing. Choosing the lowest-tiered product that adequately covers one’s tax situation avoids unnecessary expenses on premium features. For example, if a user had a simple W-2 income with no significant investments, opting for the basic version rather than a premium package would save considerable money.Another strategy was to take advantage of any free filing options provided by TurboTax or other organizations.

These often catered to low-to-moderate-income taxpayers, providing a completely free way to file their taxes. Eligibility criteria varied, so checking the requirements before making a purchase was vital.Finally, comparing prices across different tax software providers before committing to a purchase could reveal significant savings. Prices and feature sets vary, allowing for comparisons to find the most cost-effective option that meets individual needs.

Many websites offer comparison tools to simplify this process.

TurboTax 2021 Customer Support

Navigating tax season can be stressful, and having reliable customer support is crucial. TurboTax 2021 offered several avenues for users to get help when they encountered problems or had questions about the software. The availability and effectiveness of these channels varied based on user experience and the specific issue.TurboTax 2021 provided a multi-faceted approach to customer support, aiming to cater to different user preferences and technical proficiencies.

Understanding the various channels and common issues helps to paint a clearer picture of the overall user experience.

Available Customer Support Channels

TurboTax 2021 offered several ways for users to seek assistance. These included phone support, email support, and a comprehensive online help center. Phone support provided immediate assistance for urgent issues, while email support allowed for a more detailed explanation of problems. The online help center, featuring FAQs, tutorials, and troubleshooting guides, offered a self-service option for users who preferred to resolve issues independently.

The availability and accessibility of these options, however, could vary depending on the user’s subscription level and the time of year.

Common Customer Support Issues

Many users encountered similar challenges while using TurboTax 2021. These commonly included difficulties understanding specific tax forms, navigating the software’s interface, troubleshooting technical glitches, and resolving errors during the filing process. Specific examples include confusion about deductions like the child tax credit, problems importing data from previous tax returns, and encountering unexpected errors during the e-filing process. The frequency of these issues likely increased during peak tax season, potentially impacting the responsiveness of customer support channels.

Effectiveness and Responsiveness of Customer Support

User feedback regarding TurboTax 2021’s customer support varied. While many users praised the helpfulness of phone support agents, particularly those with complex tax situations, others reported long wait times and difficulty reaching a representative. Email support response times were often criticized as slow, particularly during peak season. The online help center, although comprehensive, was sometimes considered inadequate for resolving complex or unique tax-related problems.

For example, some users reported that the FAQs didn’t address their specific concerns, requiring them to resort to phone or email support. The overall effectiveness of the support system often depended on factors like the time of year, the complexity of the issue, and the specific support channel used.

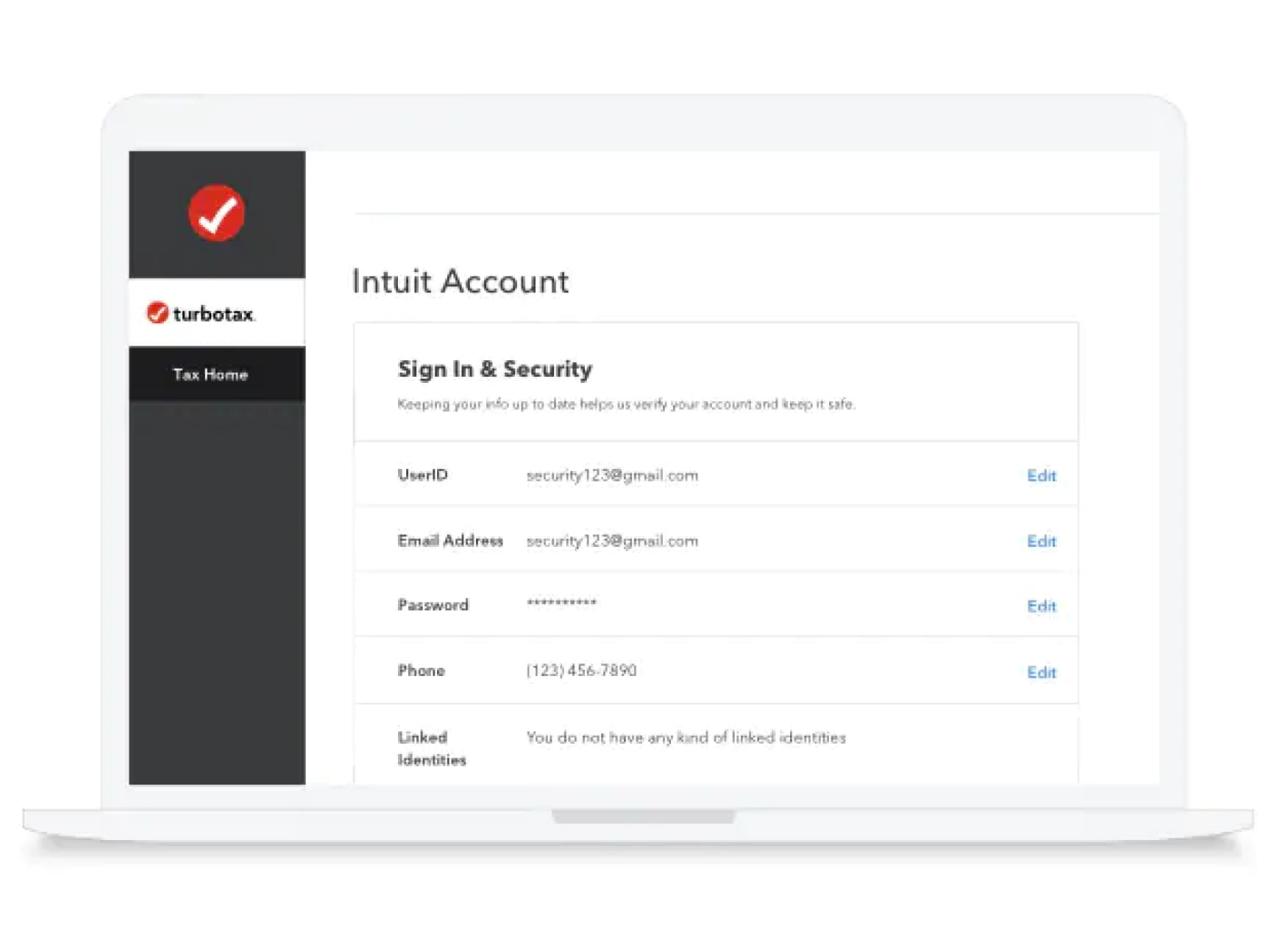

TurboTax 2021 Security and Privacy

Protecting your financial information is paramount, and TurboTax 2021 employs several security measures to ensure your data remains safe and your tax preparation process is secure. This section details the security protocols and privacy policies in place to safeguard your sensitive information.TurboTax 2021 utilizes a multi-layered approach to security. This includes robust encryption technologies to protect data both in transit and at rest.

Intrusion detection systems monitor for suspicious activity, and regular security audits are conducted to identify and address vulnerabilities. Furthermore, TurboTax adheres to strict data privacy regulations, ensuring compliance with relevant laws and best practices. The platform also employs various authentication methods to verify user identities and prevent unauthorized access.

Data Encryption and Protection

TurboTax 2021 uses advanced encryption techniques, such as SSL/TLS, to protect data transmitted between your computer and the TurboTax servers. This ensures that your personal and financial information is unreadable to anyone intercepting the connection. Data stored on TurboTax servers is also encrypted using robust algorithms to prevent unauthorized access even if a breach were to occur. This layered approach minimizes the risk of data compromise.

TurboTax 2021 Privacy Policy

The TurboTax privacy policy Artikels how Intuit, the company behind TurboTax, collects, uses, and protects user data. It details the types of information collected, such as personal identifying information, tax data, and browsing activity. The policy also explains how this data is used, for example, to provide tax preparation services, personalize user experience, and improve the product. Importantly, the policy addresses data sharing practices, clarifying with whom data might be shared (e.g., third-party service providers) and under what circumstances.

Users are encouraged to review the complete privacy policy for a comprehensive understanding of their data rights and Intuit’s data handling practices. The policy is readily available on the TurboTax website.

Potential Security Risks and Preventative Measures

While TurboTax 2021 implements robust security measures, users should remain vigilant and take proactive steps to further protect their information. Phishing scams, for example, are a persistent threat. Users should be wary of emails or messages requesting personal or financial information, as these could be fraudulent attempts to gain access to your TurboTax account. Strong, unique passwords, regularly updated, are essential, along with enabling two-factor authentication whenever available.

It’s also crucial to only access TurboTax through official websites and avoid using public Wi-Fi networks when handling sensitive financial data, as these networks are often less secure. Staying informed about common online security threats and best practices is crucial for mitigating potential risks.

TurboTax 2021 and Specific Tax Situations

TurboTax 2021 simplifies the tax filing process for various situations, offering guided navigation and helpful tips. This section details how it handles self-employment income, itemized deductions, and the import of tax forms.

Self-Employment Income Reporting

TurboTax 2021 guides users through the complexities of self-employment tax. It prompts for all necessary information, including business income and expenses, to accurately calculate self-employment tax liability (which includes Social Security and Medicare taxes). The software automatically calculates the self-employment tax deduction (one-half of your self-employment tax is deductible), preventing common errors. Users are asked to provide details about their business, including business expenses (such as office supplies, travel, and professional fees), which are then used to compute the net profit subject to self-employment tax.

The program also helps users determine if they qualify for the qualified business income (QBI) deduction, which can significantly reduce their tax burden. Remember to keep meticulous records of all income and expenses for accurate reporting and potential audits.

Itemized Deductions Reporting

Itemized deductions allow taxpayers to deduct certain expenses from their gross income, potentially lowering their taxable income. TurboTax 2021 walks users through each potential deduction, asking relevant questions to determine eligibility. For example, if a user claims a home office deduction, TurboTax will guide them through calculating the percentage of their home used for business purposes and the associated expenses.

Another example is the charitable contribution deduction; TurboTax will ask for details about the type of donation (cash, goods, etc.) and the amount, verifying that it meets IRS guidelines. Let’s say a taxpayer donated $500 in cash to a qualified charity. TurboTax would allow them to input this amount, and it will then be factored into their overall itemized deductions.

Similarly, for medical expenses, users input their total medical expenses for the year. TurboTax will then compare this total to 7.5% of their adjusted gross income (AGI) – only expenses exceeding this threshold are deductible.

W-2 and 1099 Form Import

TurboTax 2021 simplifies the process of importing W-2 and 1099 forms. Users can import these forms directly from their employers or payers using the software’s import feature. This feature typically involves entering the form’s identifying information (employer identification number, employee social security number, etc.) or uploading a digital image of the form itself. The software then automatically populates the relevant fields on the tax return, reducing the risk of manual entry errors.

If a user receives multiple W-2s (for example, from two different employers), they can import each one individually. Similarly, multiple 1099 forms, representing different sources of income (like freelance work or interest income), can be imported and processed seamlessly by the software. Accurate and timely import of these forms is crucial for a smooth and efficient tax filing experience.

TurboTax 2021 Mobile App Functionality

The TurboTax 2021 mobile app offered a convenient alternative to the desktop software, allowing users to file their taxes on the go. While sharing some core functionalities, the app and desktop versions differed in their features and overall user experience. This section will explore those differences and detail the app’s usage for tax return completion and filing.

The TurboTax 2021 mobile app aimed to streamline the tax filing process for users who preferred a mobile-first approach. However, its capabilities were naturally limited compared to the desktop version, which offered a more comprehensive and feature-rich experience.

Desktop Software vs. Mobile App Feature Comparison, Turbotax 2021

The following bullet points compare and contrast the features and usability of the TurboTax 2021 desktop software and its mobile app. Key differences revolved around screen real estate, available features, and the overall complexity of the tax preparation process.

- Interface and Navigation: The desktop version provided a more expansive and intuitive interface, allowing for easier navigation and access to all features. The mobile app, due to screen size limitations, presented a more simplified, sometimes less intuitive interface.

- Feature Set: The desktop software offered a broader range of features, including more advanced tax deductions and credits, compared to the mobile app, which prioritized ease of use for simpler returns.

- Data Entry: Data entry on the desktop was generally faster and easier due to a larger screen and keyboard access. The mobile app relied on touch screen input, which could be slower and more prone to errors for extensive data entry.

- Document Management: Managing supporting documents was more straightforward on the desktop, which allowed for easier drag-and-drop functionality. The mobile app often required more steps to upload documents.

- Overall User Experience: The desktop version provided a more comprehensive and customizable experience, catering to users with varying levels of tax knowledge. The mobile app was designed for simpler returns and users comfortable with a more limited feature set.

Using the TurboTax 2021 Mobile App to File Taxes

Filing taxes using the TurboTax 2021 mobile app involved a step-by-step process similar to the desktop version, but adapted for a smaller screen. The process generally followed these steps:

- Download and Installation: First, users needed to download and install the TurboTax mobile app from their respective app store (Apple App Store or Google Play Store).

- Account Creation/Login: Users then logged in to their existing TurboTax account or created a new one.

- Guided Interview: The app guided users through a series of questions, similar to the desktop version, to gather necessary tax information. This included personal details, income sources, deductions, and credits.

- Data Entry: Users entered their tax information directly into the app via touch screen input.

- Document Upload: Relevant supporting documents (W-2s, 1099s, etc.) could be uploaded through the app.

- Review and Filing: Once all information was entered and reviewed, users could review their tax return before e-filing. The app provided a clear summary of the return before submission.

Advantages and Disadvantages of Using the TurboTax 2021 Mobile App

The TurboTax 2021 mobile app presented both advantages and disadvantages compared to the desktop software. These factors should be considered before choosing a platform for tax preparation.

- Advantages: Convenience and portability were key advantages. Users could access and work on their taxes anytime, anywhere with an internet connection. The simplified interface was beneficial for users with simpler tax situations.

- Disadvantages: Limited features, slower data entry, and a less intuitive interface were notable drawbacks. The app was not suitable for complex tax situations requiring extensive calculations or specialized forms. Users with multiple income sources or significant deductions might find the desktop version more efficient.

TurboTax 2021 Integration with Other Services

TurboTax 2021 offered several integrations designed to streamline the tax preparation process by pulling in data from other financial accounts. These integrations aimed to reduce manual data entry and potentially minimize errors, although their effectiveness varied depending on the user’s specific financial situation and the reliability of the connected services. The availability and functionality of these integrations may also have changed since the 2021 tax season.The process of linking TurboTax 2021 with external accounts generally involved securely connecting through the software’s interface.

Users typically provided their login credentials for the relevant financial institution or service. TurboTax then securely retrieved the necessary information, such as income details from a bank account or investment account, and populated the relevant sections of the tax return. This process was intended to be secure and user-friendly, though it naturally required users to trust TurboTax with their financial account access.

Account Linking Procedures

Linking accounts in TurboTax 2021 was generally straightforward. Users would navigate to a section within the software dedicated to importing financial data. From there, they’d select the type of account they wanted to link (e.g., bank account, brokerage account, retirement account) and then follow the on-screen prompts to securely connect their accounts. The software often guided users through the process, providing clear instructions and security assurances.

It’s important to note that the specific steps might have varied slightly depending on the financial institution and the type of account being linked.

Benefits of Integrations

The primary benefit of these integrations was time savings. By automatically importing financial data, users could avoid the tedious and error-prone process of manually entering information. This was particularly helpful for individuals with multiple income sources or complex financial situations. Reduced manual data entry also lessened the chance of human error, potentially leading to a more accurate tax return.

The convenience factor was also significant, making tax preparation less daunting for many users.

Drawbacks of Integrations

While convenient, these integrations also presented some potential drawbacks. Security concerns were paramount; users had to trust TurboTax with their login credentials for various financial accounts. Although TurboTax employed security measures, the risk of data breaches always existed. Additionally, the accuracy of the imported data depended entirely on the accuracy of the information provided by the linked financial institutions.

In cases of discrepancies or errors in the source data, the user would still need to manually correct the information within TurboTax. Finally, not all financial institutions or accounts were compatible with TurboTax’s integration features.

TurboTax 2021 System Requirements and Compatibility

Getting TurboTax 2021 up and running smoothly depends on your computer’s specs and operating system. This section Artikels the minimum requirements and addresses some common compatibility issues and troubleshooting steps. Remember, exceeding these minimums will generally lead to a better user experience.

Successfully filing your taxes with TurboTax 2021 hinges on having a compatible system. Below, we detail the minimum system requirements for both Windows and macOS, followed by information on known compatibility issues and troubleshooting tips for common problems.

Minimum System Requirements

The following table Artikels the minimum system requirements for TurboTax 2021. Meeting these requirements ensures a stable and functional experience. Note that higher specifications will likely result in improved performance, especially when dealing with large tax documents or complex returns.

| Operating System | Minimum Requirements |

|---|---|

| Windows | Windows 7 SP1 or later; 2 GHz processor; 2 GB RAM; 4 GB available hard disk space; Internet connection required for online features. |

| macOS | macOS 10.13 High Sierra or later; 2 GHz processor; 2 GB RAM; 4 GB available hard disk space; Internet connection required for online features. |

Known Compatibility Issues and Limitations

While TurboTax 2021 strives for broad compatibility, certain configurations or software may present challenges. Understanding these limitations can help prevent frustration.

For example, very old or outdated operating systems might not be fully supported, potentially leading to unexpected errors or crashes. Similarly, conflicts with certain antivirus or security software are occasionally reported. Intensive background processes running concurrently with TurboTax might also impact performance. Finally, using extremely low RAM or hard drive space could lead to slowdowns or program instability.

Troubleshooting Common Technical Problems

Encountering technical difficulties is sometimes unavoidable. The following steps offer solutions to common problems encountered during TurboTax 2021 usage.

Problem: TurboTax 2021 is running slowly or freezing.

Solution: Close unnecessary applications, ensure sufficient RAM and hard drive space, and consider restarting your computer. Check for software updates and ensure your antivirus isn’t interfering.

So, you’re dealing with TurboTax 2021? That can be a headache, especially if you’re on a budget. Luckily, there’s a way to avoid those hefty fees; check out the turbotax free options to see if you qualify. Knowing your options beforehand can make tackling your TurboTax 2021 return way less stressful.

Problem: TurboTax 2021 is crashing or displaying error messages.

Solution: Try restarting your computer. Check for updates to TurboTax itself. If the problem persists, contact TurboTax support for assistance.

Problem: Unable to download or install TurboTax

2021.

Solution: Verify your internet connection. Check your download folder for corrupted files and try re-downloading. Ensure you have sufficient hard drive space.

Problem: TurboTax 2021 is not recognizing certain files.

Solution: Ensure the files are in the correct format and location. Try restarting TurboTax or your computer. Check file permissions to ensure TurboTax has access.

Closing Notes

Ultimately, TurboTax 2021, like any tax software, is a tool – its effectiveness depends heavily on the user’s needs and technical skills. While it boasts a range of features and generally user-friendly design, potential users should carefully weigh the pros and cons, considering their individual tax situation and comfort level with technology before committing. Understanding its limitations and exploring alternative options if necessary is key to a smooth and stress-free tax season.

Essential FAQs

Did TurboTax 2021 offer free filing options?

Yes, TurboTax 2021 offered a free version for simple tax returns, but more complex situations often required upgrading to a paid version.

What happened to my TurboTax 2021 data after filing?

Intuit, the company behind TurboTax, generally retains user data for a period of time for record-keeping and compliance purposes. Their privacy policy details this.

Could I amend my 2021 tax return using TurboTax 2021?

While TurboTax 2021 itself may not have had an amendment feature directly, Intuit likely provided tools or guidance on their website to amend returns filed through their software.

How did TurboTax 2021 handle state taxes?

TurboTax 2021 handled state taxes depending on the chosen version. Some versions included state tax filing while others required separate purchases.

Were there any known bugs or glitches in TurboTax 2021?

As with any software, some users reported bugs or glitches. Online forums and review sites might provide details on specific issues encountered.